As technology continues to evolve, its influence on small business loans is becoming increasingly significant. By 2025, we can expect streamlined application processes, enhanced data analytics for risk assessment, and greater access to funding through online platforms. This transformation will empower small businesses, making financing more accessible and efficient, ultimately fostering growth and innovation in the entrepreneurial landscape.

The landscape of small business financing has undergone significant transformations over the past decade, largely driven by advancements in technology. As we look towards 2025, it's crucial to understand how these changes will continue to shape small business loans and what entrepreneurs can expect. With the emergence of new tools and platforms, the process of securing a loan is becoming more streamlined, efficient, and accessible.

One of the most significant impacts of technology on small business loans is the increased accessibility to funding. Traditional banks often impose strict requirements and lengthy approval processes that can deter small business owners. In contrast, technology-driven lenders and online platforms have emerged, allowing business owners to apply for loans with minimal documentation and faster turnaround times.

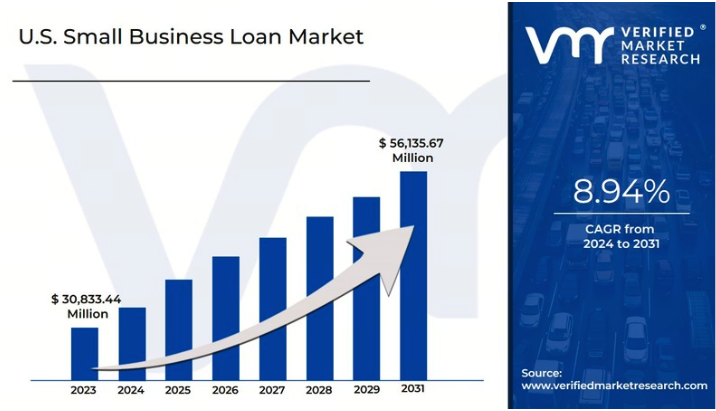

By 2025, it is anticipated that the barrier to entry for small businesses seeking funding will lower even further. Online lending platforms will leverage data analytics and artificial intelligence (AI) to assess creditworthiness more accurately. This means that even businesses with limited credit histories or unconventional business models can find suitable financing options. As a result, more entrepreneurs will have the opportunity to access **small business loans** that were previously out of reach.

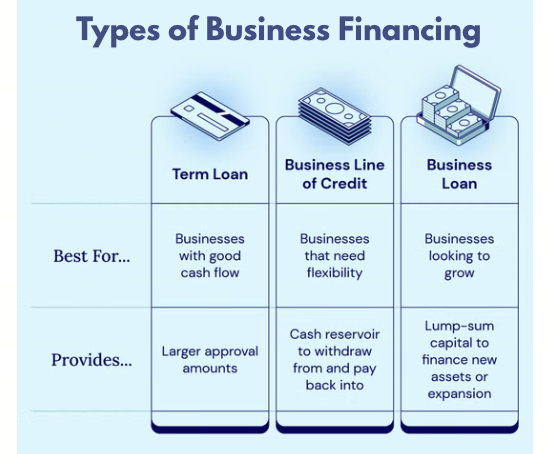

In 2025, alternative financing options such as crowdfunding, peer-to-peer lending, and revenue-based financing will likely gain even more traction. These alternatives offer unique advantages for small businesses, such as flexible repayment terms and the ability to raise capital without giving up equity.

Platforms like Kickstarter and Indiegogo have already demonstrated the potential of crowdfunding for small businesses. By the end of 2025, we can expect these platforms to evolve further, with enhanced features and tools that help businesses engage their supporters more effectively. The rise of **peer-to-peer lending** will also continue, providing small businesses with direct access to individual investors who are willing to fund their ventures.

Another area where technology is making a significant impact is in the risk assessment process. Traditional lenders often rely on credit scores and financial statements to evaluate loan applications, which can be limiting. However, the integration of **big data** and machine learning algorithms will enable lenders to analyze a broader range of data points, including social media activity, transaction history, and industry trends.

By 2025, we expect that small business lenders will utilize sophisticated data analytics tools to create a more comprehensive view of a business's financial health. This will not only streamline the approval process but also lead to more personalized loan offerings tailored to the specific needs of individual businesses. With this technology-driven approach, small business owners will have a better chance of securing funding that aligns with their growth objectives.

As mobile technology continues to advance, its role in small business financing cannot be overlooked. In 2025, we can expect to see a surge in mobile applications that facilitate loan applications and management. Business owners will have the convenience of applying for loans, tracking their applications, and managing repayments directly from their smartphones.

This shift towards mobile-first solutions is crucial for small business owners who are often on the go and may not have the time to visit a traditional bank. Moreover, as more people rely on their mobile devices for everyday transactions, lenders will need to adapt their platforms to meet these expectations. The result will be a more user-friendly experience that encourages small business owners to seek the financing they need.

As technology continues to shape the small business loan landscape, regulatory changes will also play a vital role. Governments and regulatory bodies are beginning to recognize the importance of innovation in the lending sector. By 2025, we can expect to see a more favorable regulatory environment that encourages the integration of technology in lending practices.

This may include updated regulations that support the use of alternative data in credit assessments and streamlined compliance processes for online lenders. As a result, small business owners will benefit from faster loan approvals and more transparent lending practices. The combination of technology and favorable regulations will create a more robust ecosystem for small business financing.

In conclusion, the impact of technology on small business loans is profound and will only continue to grow in the coming years. By 2025, entrepreneurs can expect increased accessibility to funding, enhanced risk assessment through data analytics, and a greater variety of financing options. The integration of mobile technology will make the loan application process more convenient, while regulatory changes will pave the way for innovation in the lending industry.

Small business owners who embrace these technological advancements and stay informed about the evolving landscape will be better positioned to secure the financing they need for growth and success. As we move towards 2025, the future of small business loans looks promising, and the opportunities for entrepreneurs are boundless.

The Future of Small Business Loans: Trends to Watch in the USA for 2025

How to Qualify for Small Business Loans in 2025: A Step-by-Step Approach

Secure Your Business's Future: Best Small Business Loans in 2025

Top Small Business Loans in the USA for 2025: A Comprehensive Guide

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs

Comparing Small Business Loan Options in the USA: 2025 Edition

Government Grants vs. Small Business Loans: Which is Better for Your USA Business in 2025?

Success Stories: How Small Business Loans Transformed Enterprises in the USA by 2025