Navigating the landscape of small business loans in 2025 can be challenging. This guide offers a comprehensive, step-by-step approach to help entrepreneurs understand the qualification process. From assessing your financial health to preparing necessary documentation, we’ll provide practical insights and tips to enhance your chances of securing the funding needed to grow your business.

Securing a small business loan can be a crucial step for entrepreneurs looking to expand or sustain their businesses. As we move into 2025, understanding how to qualify for small business loans is more important than ever. In this article, we’ll provide a step-by-step approach to help you navigate the process and improve your chances of securing funding.

Before applying for a small business loan, it’s essential to assess your financial health. Lenders will scrutinize your financial records to determine your ability to repay the loan. Key factors to evaluate include:

By thoroughly evaluating these aspects, you can get a clearer picture of your financial standing and make necessary adjustments before seeking a loan.

A well-crafted business plan is a vital component of your loan application. This document should clearly outline your business goals, market analysis, operational plan, and financial projections. Key elements to include are:

A strong business plan not only helps you qualify for a loan but also serves as a roadmap for your business’s future.

Different lenders may require various documents, but generally, you should be prepared to provide:

Having these documents organized and ready will streamline the application process and demonstrate your professionalism to potential lenders.

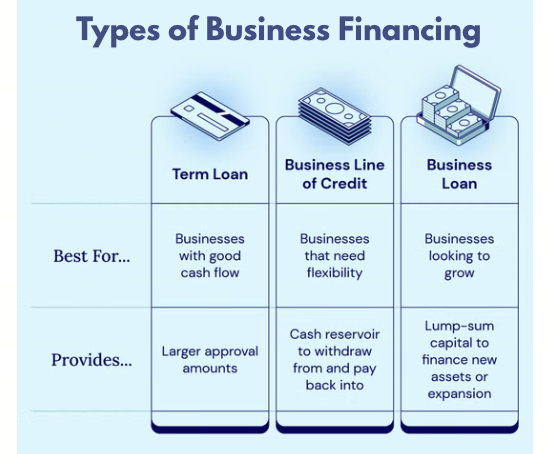

In 2025, various small business loan options are available, each with different qualification criteria. Here are some common types of loans to consider:

Evaluate the pros and cons of each type to find the best fit for your business needs.

Establishing a relationship with lenders can significantly improve your chances of securing a loan. Start by:

Building rapport with lenders can lead to better terms and a more personalized lending experience.

Once you have prepared all necessary documents and selected a lender, it’s time to submit your application. Pay attention to detail, as errors can delay the process or lead to rejection. Here are some tips:

After submitting your application, be prepared for follow-up questions from lenders. They may want to clarify certain aspects of your financials or business plan. Respond promptly and thoroughly to show your commitment and transparency.

Qualifying for small business loans in 2025 requires careful planning and preparation. By assessing your financial health, crafting a solid business plan, gathering necessary documentation, exploring different loan options, building lender relationships, and submitting a thorough application, you can significantly enhance your chances of securing the funding you need. Remember, each step is crucial in presenting yourself as a reliable and viable candidate for a small business loan.

By following this step-by-step approach, you can navigate the loan application process with confidence and set your business up for success.

Secure Your Business's Future: Best Small Business Loans in 2025

Top Small Business Loans in the USA for 2025: A Comprehensive Guide

Navigating Small Business Loans in 2025: Essential Tips for Entrepreneurs

The Future of Small Business Loans: Trends to Watch in the USA for 2025

Comparing Small Business Loan Options in the USA: 2025 Edition

The Impact of Technology on Small Business Loans: What to Expect in 2025

Government Grants vs. Small Business Loans: Which is Better for Your USA Business in 2025?

Success Stories: How Small Business Loans Transformed Enterprises in the USA by 2025