Discover the essential information on the best life insurance plans available in the USA for 2025. This comprehensive guide highlights key features, benefits, and coverage options from leading providers, helping you make informed decisions to secure your financial future. Whether you’re a first-time buyer or looking to update your policy, find the perfect coverage suited to your needs.

Life insurance is a crucial financial tool that provides security and peace of mind. It ensures that your loved ones are financially protected in the event of your untimely demise. As we approach 2025, it's essential to understand the various types of life insurance plans available and how they can cater to your unique needs. With numerous options in the market, choosing the right plan can be overwhelming, but this guide aims to simplify the process.

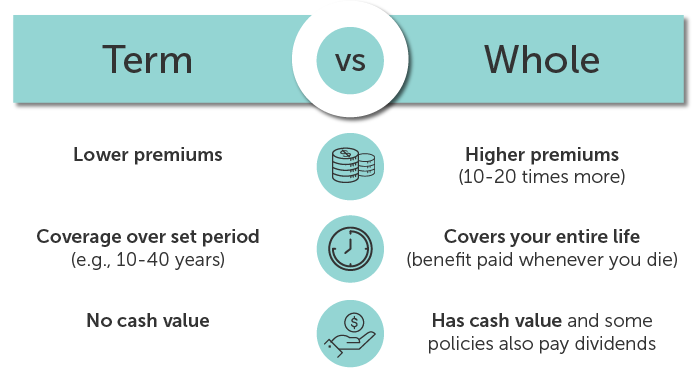

Before diving into the top life insurance plans for 2025, it's important to understand the main types of life insurance:

Here is a chart summarizing some of the top life insurance plans available in the USA for 2025:

| Insurance Provider | Type of Plan | Key Features | Average Annual Premium |

|---|---|---|---|

| State Farm | Whole Life | Guaranteed death benefit, cash value growth | $1,300 |

| Northwestern Mutual | Term Life | Customizable term lengths, conversion options | $900 |

| Prudential | Universal Life | Flexible premiums, investment options | $1,000 |

| MassMutual | Variable Life | Investment choices, potential cash value growth | $1,500 |

| New York Life | Term Life | Level premiums, renewable options | $950 |

State Farm offers a robust whole life insurance plan that not only provides a guaranteed death benefit but also accumulates cash value over time. This plan is ideal for those seeking lifelong coverage along with a savings component. The average annual premium is around $1,300, making it a reasonable choice for many families.

Northwestern Mutual stands out with its customizable term life options. Policyholders can select from various term lengths and have the option to convert to permanent insurance later. With an average annual premium of $900, this plan provides affordable protection for families looking for temporary coverage.

Prudential offers a universal life insurance plan that combines the benefits of permanent coverage with flexible premiums. This plan allows policyholders to adjust their payments and death benefits according to their changing financial situations. The average annual premium for this plan is approximately $1,000.

MassMutual provides a variable life insurance plan that allows policyholders to invest the cash value in multiple investment options. This can lead to potential cash value growth, making it an attractive choice for those looking for a blend of insurance and investment. The average annual premium is about $1,500.

New York Life offers a reliable term life insurance plan with level premiums and renewable options. This plan is perfect for individuals or families who want to ensure that their loved ones are protected during critical years. The average annual premium for this plan is around $950.

When deciding on a life insurance plan, consider the following factors:

Choosing the right life insurance plan is a crucial step in securing your family's financial future. With various options available in 2025, including term and permanent life insurance, understanding your needs and researching providers is essential. Whether you opt for a whole life policy from State Farm or a term plan from Northwestern Mutual, ensure that your decision aligns with your financial goals and provides the protection your loved ones deserve.

Understanding the Benefits of Term vs. Whole Life Insurance in 2025

How to Choose the Best Life Insurance Plan in the USA: 2025 Insights

The Impact of COVID-19 on Life Insurance Trends in the USA for 2025

Affordable Life Insurance Plans: What You Need to Know in 2025

Navigating Life Insurance for Seniors: Best Plans in the USA for 2025"

Best Life Insurance Plans in the USA in 2025

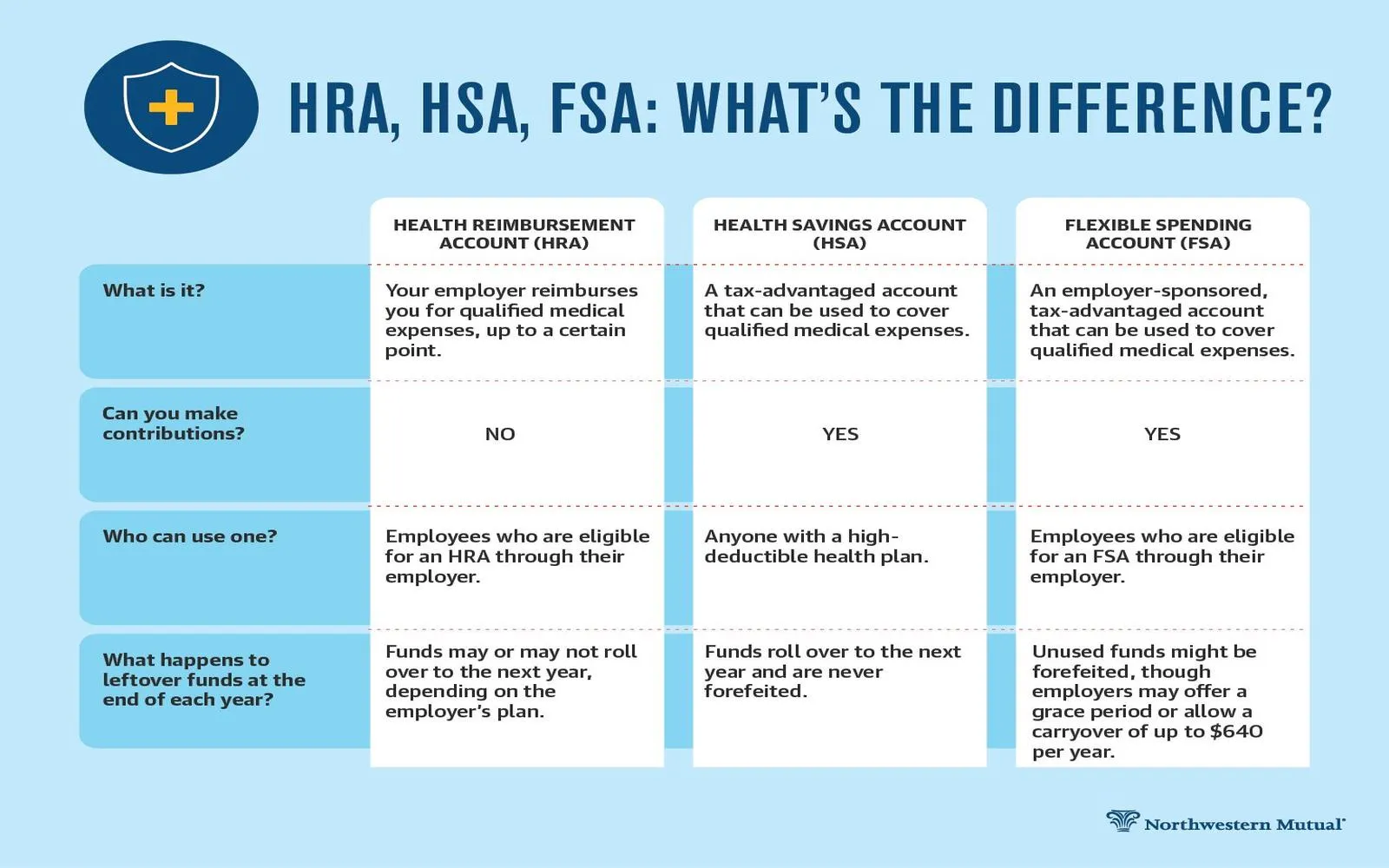

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

Best Health Insurance Plans in the USA (2025)