Navigating health insurance plans for families in the USA can be challenging, especially as options evolve. In 2025, it’s crucial to understand the diverse range of plans available to ensure you find the best fit for your family's unique healthcare needs. This guide explores various options, helping you make informed decisions for your family's health and financial well-being.

As we move closer to 2025, selecting the right health insurance plan for families in the USA is becoming increasingly important. With rising healthcare costs and a variety of options available, it’s essential to find a plan that not only fits your budget but also meets the needs of your family. In this article, we will explore the key factors to consider when choosing a health insurance plan and highlight some of the best options available in 2025.

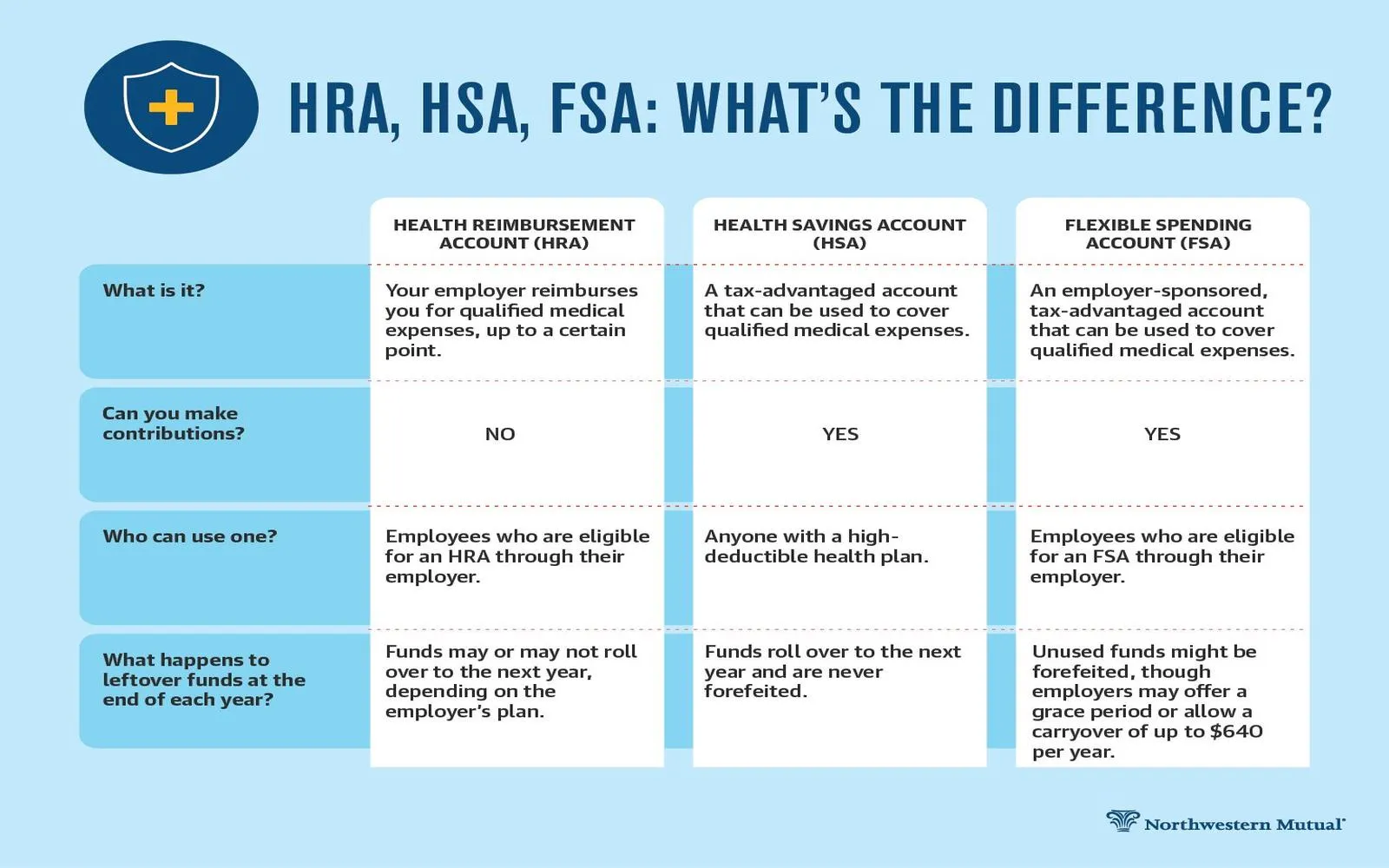

Health insurance plans can vary widely in terms of coverage, premiums, deductibles, and out-of-pocket expenses. Families should familiarize themselves with the different types of plans available:

When evaluating health insurance plans for families in the USA, consider the following factors:

Based on market analysis and expert recommendations, here are some of the best health insurance plans for families in the USA for 2025:

| Plan Name | Type | Average Monthly Premium | Deductible | Out-of-Pocket Max |

|---|---|---|---|---|

| Blue Cross Blue Shield Family Plan | PPO | $600 | $3,000 | $6,000 |

| Kaiser Permanente Family Plan | HMO | $540 | $2,500 | $5,500 |

| Aetna Family Health Plan | EPO | $580 | $2,800 | $6,500 |

| UnitedHealthcare Family Plan | PPO | $620 | $3,500 | $7,000 |

Here are some practical tips to help you choose the best health insurance plan for your family:

Finding the best health insurance plan for families in the USA in 2025 requires careful consideration of various factors including costs, coverage options, and family health needs. By understanding the different types of plans available and comparing your options, you can make an informed decision that ensures your family has the coverage they need. Remember to evaluate all aspects of a plan, including premiums, deductibles, and out-of-pocket maximums, to find the best fit for your family’s unique situation.

The Impact of Legislation on Health Insurance Plans in the USA 2025: What to Expect

Health Insurance Plans in the USA 2025: A Comprehensive Guide to Coverage Options

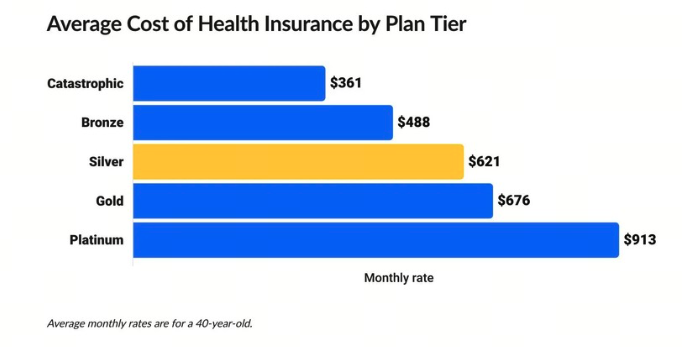

Understanding the Cost of Health Insurance Plans in the USA 2025: What You Need to Know

Top Trends in Health Insurance Plans in the USA 2025: Innovations and Changes Ahead

How to Choose the Right Health Insurance Plan in the USA 2025: Tips for Consumers

Best Health Insurance Plans in the USA (2025)

Best Crossover SUVs for Families in the USA 2025

Cell Phone Deals for Families: How to Save Big in the USA in 2025